Turkey's economy is considered a highly resilient one by many market observers, analysts and representatives of credit rating agencies, as it is resisting so much uncertainty and fragility.

It has been two months since the election was held in the country and there is no government in sight. Coalition talks have not yielded any results and a new election is likely to be held in November. The country's business associations, from all sides and ideologies, expressed their opinion as, "There is no need for a new election; let us try a coalition, let us move ahead. We lost 2015; at least let us not also lose 2016." This also did not yield any results. Not even five months after the June 7 election, there will be a new general election.

This political situation which could be called chaotic has added political risks to the economic risks of the country. Moreover, when the armed clashes across the Syrian and Iraqi borders are considered, Turkey's economy is accumulating risks over risks.

Nevertheless, when the effect of what has been experienced up to today on the economy is considered, it can be seen that it was not as destructive as expected. There were no turbulences to the extent of a crisis.

For instance, at other times, this much turbulence was enough to drive foreign investors away. The dollar/Turkish Lira parity should have skyrocketed at shocking dimensions. In the 1994 and 2001 crises, it happened like this; there were crises that caused the country to shrink 5 to 6 percent while unemployment climbed to 20 percent. Each time the door of the International Monetary Fund (IMF) was knocked and only with the bitter recipes recommended, the equilibriums were brought back to manageable dimensions.

This time, it is happening differently. Turbulences arrive in small doses; when you add them up altogether, it is not small but not at "shocking" levels.

Let us take the local currencies against the U.S. dollar in the past year. The Turkish Lira's loss against the dollar in 12 months is not small; from July 2014 to July 2015, it lost 23 percent. However, this loss, when the devaluations of several other emerging country local currencies are taken into account, is not considered very high. The Russian ruble - even though it started recovering recently - lost 65 percent in one year.

The second biggest fragile country, Brazil, lost 50 percent against the dollar while Colombia lost 54 percent. The Mexican peso lost 25 percent value against the dollar in one year. Turkey's 23 percent loss comes after them.

Factors

Turkey's risks are not only economic; it has huge political and geopolitical risks. Despite this, it is in a better situation than Russia, which also has huge geopolitical risks and whose economy was knocked out because it was subject to the economic embargo of the West. It is also relatively better than Brazil, whose risks are more economic. But that's about it. Turkey is ahead of other emerging fragile countries in being risky by far. However, data shows us that the risk coefficient is constantly increasing.

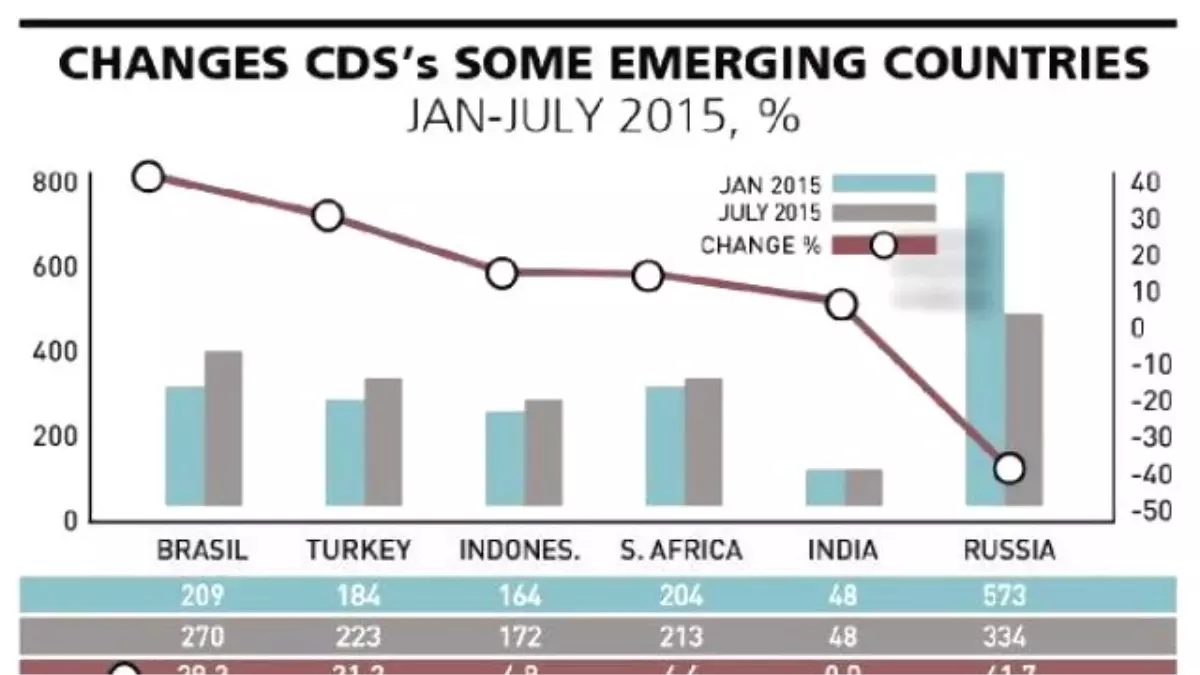

The Credit Default Swap (CDS) of January and July this year, in other words the increase in risk premiums, reached 21 percent for Turkey. Our CDS was 184 at the beginning of 2015; it went up to 223 as the average in July.

The increase of Brazil's CDS in the same period was 29 percent. On the other hand, Russia accelerated normalization and its risk premium decreased 41 percent, even though it still holds the top place with its 334 CDS.

Domestic insurances

The domestic factors that made it possible for Turkey's economy to look resilient despite the harsh internal and external winds are the ones based on measures taken after the 2001 crisis. These are the measures taken both in the banking sector and in public accounting.

After the 2001 crisis, in cooperation with the IMF, even though the social prices paid for them were heavy, with certain "reforms" a banking system resilient to waves and which is pretty much under control was created. The bad apples were picked. About 20 banks experienced operations and a banking Regulation and Supervision Agency (BDDK) was formed to monitor the banks closely. The banks were forced both to strengthen their equity capitals and eliminate their weak loans. Many banks were sold; some of them were bought by strong foreign banks. Because of this entire rehabilitation, the banking system is under more control now, has much less risks. For this reason, up until now, - at least for the moment - strong winds have not created any cracks or explosions in the banking system. But this does not mean there is no danger.

The net exchange position that shows the difference between receivable and payable positions of the real sector is one of the most important issues. As of the end of April 2015, real sector institutions have $102.8 billion in foreign exchange assets; on the other hand, their liabilities are around $278.5 billion. In other words, the difference between assets and liabilities is $175.7 billion.

If the real sector attempts to decrease its liabilities by using up all its assets, again it faces about $176 billion of debt.

At the end of April, the dollar rate was around 2.66. It reached 2.76 in July, increasing 0.10 liras. This increase of 0.10 liras corresponds to a loss of 17.6 billion liras in the open position of the real sector in liras. When these exchange losses increase, then the problem may infect banks. This deficiency causes losses to firms with each devaluation; balance sheets weaken and liabilities to banks become difficult to fulfill. But, for the moment, the system is resilient to blows.

The other breakwater preventing a devastating economic crisis is public finance. Again since the 2001 crisis, public finance which was rehabilitated with "fiscal discipline," is an assurance especially for foreigners. The central budget was tightened after the 2001 crisis, public economic enterprises were rapidly privatized, the social security system was restructured and a fiscal discipline was introduced to agricultural subvention, related institutions and municipalities. All of these enabled a sharp decrease in public deficits and the level of public debts reached reasonable levels, such as around 35 percent of the national income. Today, public finance, which has a deficit of only 1 to 1.5 percent of the national income, is an assurance, a safety for the foreign investor, independent of other domestic tremors.

Foreign factors

It is also foreign factors which play a role in why Turkey's economy is not shaking. The worst negativity for Turkey would be for the foreigners to exit. They do exit and they do not come back with the same enthusiasm as they used to. But the factor that is preventing the total exit of foreigners is the uncertainty in the U.S. and the uncompleted decision of increasing interest rates.

The stance of the U.S. Central Bank Fed is uncertain with its "I increased, will increase, I cannot increase, not for now," interest rate policy, causing foreigners to pass the ball around.

Even though they see the increasing risks in Turkey, they exit slowly. They do not detect any brighter development in other countries. They are careful about China. The only strong country is India, which is growing, decreasing interest rates and drawing foreign direct investment.

It is obvious that Turkey's "resilient" state is a seasonal state. As soon as uncertainties come to an end, anything that did not happen in Turkey today, everything that is waiting at the door, may come pouring in. When that time comes, then the consequences will truly be heavy... This is inevitable…

(Graph) - Istanbul

Son Dakika › Güncel › Turkish Economy Continues To Accumulate Political And Economic Risks - Son Dakika

Adana'da düzenlenen Portakal Çiçeği Karnavalı'nda, Türk Tekstil Vakfı Mesleki ve Teknik Anadolu Lisesi öğrencilerinin atıklardan yaptığı ürünler, İl Milli Eğitim Müdürlüğü standında sergilendi. Karnavalın ana teması olan karbon ayak iziyle ilgili bilinçlendirme yapılırken, öğrencilerin geri dönüşüm bilincini ve doğa sevgisini aşıladığı belirtildi.

Alaca Belediyesi, bayar ayarlarının kurak geçmesi nedeniyle yağmur duası etkinliği düzenledi. Cuma namazının ardından Cumhuriyet Meydanı'nda toplanan vatandaşlar, Alaca Belediye Başkanı Şerif Arslan ile birlikte yağmur duası yaptı.

Ali Rıza Ataktürk Caddesi'nde Y.E.Y. idaresindeki 22 ADG 393 plakalı motosiklet, yolun karşısına geçmeye çalışan anne ve kızına çarptı. Kazada anne ve kızı yaralandı. Haber verilmesi üzerine olay yerine polis ve sağlık ekipleri gönderildi. Yaralılar, sağlık ekiplerinin olay yerindeki ilk müdahalesi sonrası hastaneye kaldırıldı. Motosiklet sürücüsü ifadesine başvurulmak üzere polis merkezine götürüldü.

Büyükçekmece'de yağışlı havanın etkisiyle kayganlaşan yolda kontrolden çıkan İETT otobüsü, bir kısmı yan yola girerken bir kısmı da D-100 kara yolunu kapattı. Yolcuların tahliye edildiği kazada bir kişi hafif yaralandı. İtfaiye ve polis ekipleri olay yerine sevk edildi. Ankara istikameti bir süre trafiğe kapanan D-100 kara yolunda uzun araç kuyruğu oluştu. Otobüsün bir kısmının çekilmesinin ardından trafik akışı tek şeritten sağlanmaya başlandı.

Eyüpsultan'da meydana gelen trafik kazasında hayatını kaybeden zabıta memuru Semih Çakıllı, Piyale Paşa Camii'nde kılınan cenaze namazının ardından son yolculuğuna uğurlandı. Kazada ağır yaralanan Çakıllı, hastanede yapılan tüm müdahalelere rağmen kurtarılamayarak hayatını kaybetti. Cenaze namazına ailesi, yakınları ve zabıta meslektaşları katıldı.

Sizin düşünceleriniz neler ?